The Archdiocese of St. Paul and Minneapolis chancery building sits near the foot of the Cathedral of St. Paul, overlooking downtown St. Paul. Jeffrey Thompson | MPR News

The bankruptcy of the Archdiocese of St. Paul and Minneapolis takes another step forward Tuesday afternoon with the first meeting of the creditors committee.

Citing clergy-abuse lawsuits and the costs of future claims, the archdiocese filed for bankruptcy in January. Its Chapter 11 filing requires alleged victims to file claims in federal court as creditors.

Explore the full investigation Clergy abuse, cover-up and crisis in the Twin Cities Catholic church

So far, five people — all alleged victims of clergy sex abuse — have been named to the committee. Payouts to them and other creditors will depend greatly on what assets the archdiocese has available for compensation — a factor that likely will set in motion a detailed search for church assets.

The archdiocese and attorneys for abuse victims hope that insurance will cover a large portion of abuse claims that will be settled through the bankruptcy process, with church insurers potentially providing $100 million or more.

Insurers are contesting coverage claims by the archdiocese, with some companies claiming they owe the archdiocese nothing for claims related to abusers whom the church identified but failed to stop.

But in bankruptcies prompted by sex abuse claims, a diocese typically contributes something to a settlement with victims.

A big question is what the Twin Cities archdiocese could offer the 150 or so people with abuse claims.

"The answer is: 'It depends,' " said Christopher Soper, a University of Minnesota law professor and attorney who has been involved in several Catholic Church bankruptcies. He expects close scrutiny of archdiocese accounting and the church's relations with other Catholic organizations.

"It's a pretty common way for creditors of the debtor to try to gin up more assets to spread around," Soper said. "I'm sure all the interested parties will be looking very carefully at the archdiocese finances to see if the various entities are really as separate as they claim."

Toward that end, forensic accountants will dig into the finances of the archdiocese, hunting for anything of significant value that may not have been already disclosed. They'll also peruse pension plans, parishes, schools, cemeteries, charities and other Catholic entities, looking for any money and assets that could be deemed to be property of the archdiocese.

Archbishop John Nienstedt Jeffrey Thompson / MPR News

Archbishop John Nienstedt and other diocese leaders serve on many of the boards of those organizations. The archdiocese insists parishes, schools, cemeteries, charities and other Catholic entities are legally separate and their assets — which could be worth several hundred million to more than $1 billion -- should be beyond the reach of creditors.

But Jennifer Haselberger, a former archdiocese canon lawyer and whistleblower on abuse, argues that many of those assets may still be at risk.

In a recent blog post, she wrote that creditors could make the case that the archdiocese exerts enough control over parishes and other Catholic entities that legal separation effectively does not exist.

While many parishes are in debt or have few or no assets of value to creditors, Haselberger said a fair number of them hold a significant amount of property.

Jennifer Haselberger Jennifer Simonson | MPR News 2013

"St. Katherine Drexel, for instance, has more than thirty undeveloped acres in Ramsey, and Sts. Joachim and Anne about ten acres in Shakopee," she wrote in her blog post. "Other parish corporations hold undeveloped land, commercial real estate, rental housing, etc."

In its bankruptcy filing, the archdiocese reported net assets of only about $30 million. But that includes about $14 million in trust accounts that fund medical and dental health plans.

Larry Ricke, the attorney for the trustees of the archdiocese's medical and dental plans, said that more than 90 percent of the money in the plans comes from Catholic parishes, schools and other organizations and some 3,350 of their employees.

"The funds ... were contributed by participating employers, primarily the parishes and schools, and their individual employees and are to be used solely for the purpose of paying the medical and dental claims of the employees," Ricke wrote in an email.

The archdiocese has about $2 million in funds that it contends have donor restrictions on how the money can be used.

The bankruptcy also likely will cost the archdiocese millions of dollars in legal and other professional fees. That's money that won't go to abuse victims. In just the 90 days before its bankruptcy filing, the archdiocese paid legal and consulting firms about $2 million.

Indeed, the financial state of the archdiocese appears dire when the potential cost of compensating abuse victims is factored in. Archdiocese auditors late last year warned that there was substantial doubt about the chancery's ability to continue as a going concern.

Jack Ruhl, an accounting professor at Western Michigan University who has worked with victims' attorney Jeff Anderson, believes the archdiocese has more assets than it admits.

"I would not conclude that there's not much there," he said. "There's a lot of different pots of money. There are entities like the cemeteries, the pension fund."

There is also property. The archdiocese has reported real estate holdings that it values at least $11 million. The two most attractive properties are the Hayden Center on West Kellogg Boulevard and the chancery on Summit Avenue.

A development on the chancery property could include scores of high-end apartments or a few luxury homes with spectacular views of the river valley. But developer James Stolpestad, chairman of Exeter Group, which has developed many projects in St. Paul, said such projects could be too impractical to provide much value in bankruptcy.

"The biggest issue would be the historic approvals, local, state and federal, because it's a national historic district long Summit," he said.

The Archdiocese of St. Paul and Minneapolis chancery building sits near the foot of the Cathedral of St. Paul, overlooking downtown St. Paul. Jeffrey Thompson | MPR News

Archdiocese real estate holdings also include the Cathedral of St. Paul and land under three Catholic high schools. But church officials doubt those properties have much value.

The cathedral has an estimated market value for tax purposes of about $21 million. But there is a $4.5 million loan on the cathedral and archdiocese officials say the property has very high maintenance costs, substantial deferred maintenance, limited potential and no "realizable value."

It's not unheard of, however, for grand churches or temples to be sold, typically to followers of another faith.

"Churches can be sold like any other property," said Catharine Wells, a Boston College law professor who has followed church bankruptcies across the country. "There certainly isn't in most states any special exemption for church property."

In 2012, The Catholic Diocese of Orange, California bought the Crystal Cathedral that was built for televangelist Robert Schuller, paying nearly $60 million for the church and its 34-acre campus.

The Twin Cities archdiocese estimates the land under the Totino Grace, Benilde-St. Margaret's and DeLaSalle high schools has a combined estimated market value of $13.7 million. But it reported that the value of its interest in the properties is "unknown."

That reflects uncertainty about what value the land could have given its current use and zoning and other restrictions on the properties.

Each school pays $1 a year to lease land from the archdiocese. DeLaSalle President Barry Lieske said he doesn't expect the bankruptcy to affect his school financially.

DeLaSalle High School in Minneapolis. Jennifer Simonson | MPR News

"DeLaSalle is confident that the archdiocese bankruptcy will have no impact on what we do," he said. "We're a separately incorporated nonprofit."

There are more than 200 undeveloped acres of land in Catholic cemeteries in New Hope and Mendota Heights.

According to the archdiocese, the cemeteries are part of a separate legal entity, established in 1969.

Public records indicate the archbishop and two other high ranking archdiocese officials have seats on the cemeteries' boards and they appoint other board members.

John Hedback, the attorney for the cemeteries, said their officials don't see how those properties could be tapped to pay archdiocese creditors.

"We don't believe there's been any action since they were spun off which would give result in it being a source of funds," he said.

But Charles Zech, director of the Center for Church Management and Business Ethics at Villanova University, expects the relationship will be closely examined.

Resurrection Cemetery in Mendota Heights is the largest cemetery in the Archdiocese of St. Paul and Minneapolis. Less than half of the total 350 acres have been developed for current cemetery use. Jeffrey Thompson | MPR News

"That'd be up to the court to decide how separate they are," he said. "But potentially the undeveloped cemetery land could be part of the settlement."

The assets of the cemeteries is unknown, as they do not have to file public financial reports. In the Archdiocese of Milwaukee's bankruptcy, creditors have been trying to access a $60 million cemetery trust fund.

There is a lot of money — probably more than $100 million — in the priest and lay employee pension plans overseen by the archdiocese. The plans cover 401 priests and 5,079 current and former employees of the archdiocese, parishes, schools and other Catholic organizations.

But archdiocese officials say the pensions are not archdiocese property and "our understanding is that the plan assets should not be available to the creditors."

The archdiocese also contends that the plans currently do not have enough money to pay future obligations. As of the end of 2010, internal church documents indicate the plans had about $114 million in assets and were on the hook to pay projected benefits of $183 million.

The current state of the pensions is unclear because they are not subject to the public reporting requirements that most pensions are. But the archdiocese plans to issue a pension funding report next month.

Given the stock market's rise in recent years, the gap between pension assets and obligations likely narrowed. But Zech expects the pensions' funding could be diminished by the bankruptcy. Zech said archdiocese assets that could fund the pensions could be diverted toward a settlement with abuse victims. He said that happened in the Wilmington, Del., church bankruptcy.

"They're certainly in for some financial hit," he said.

As church plans, the pension plans are not subject to federal reporting requirements, nor are they backed by the Pension Benefit Guaranty Corporation.

Overall, Zech said, the archdiocese appears to have done a good job to limit the damage that can be done by big legal settlements. It has largely accomplished that by ensuring that related Catholic entities are set up as separate legal entries, which could put them beyond the reach of archdiocese creditors.

Villanova professor Charles Zech Courtesy of Charles Zech

But that doesn't mean the archdiocese could not raise money from those organizations, deep-pocketed individual donors and the rest of the Twin Cities Catholic community.

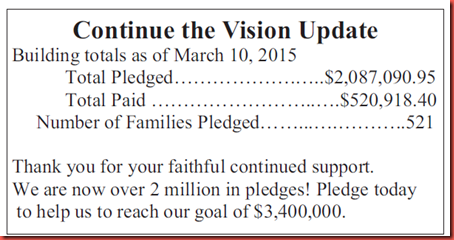

Zech said the archdiocese could ask the Catholic community to contribute toward a settlement. He said that the archbishop could even order parishes to contribute, since he controls most of the seats on individual parish boards.

"The archbishop says, 'Your parish will contribute.' They will contribute," Zech said.

But parishioners might rebel against such an edict — Zech doubts Archbishop John Nienstedt would try to tap other Catholic organizations, unless there is court pressure to do so.

"I can't see the archdiocese not fighting this tooth-and-nail and not trying to pay as little as possible to the victims," Zech said.

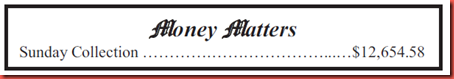

![[image%255B9%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhwlHQSsMoX8B1Z_H2xbEhApdSiy2eSZ87pfGSIsUnzjNTn10xJdEsWXYgwbf3722DyKmVh0Jnt_cVsovxdRxsgpopajG_3lxAVVtm0JRvnwBXi1AQosAM0QLDqQNtalwzlvD_kPlJpP60F/s1600/image%25255B9%25255D.png)

![[image%255B9%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiC66URPz8Kp_NNtC7wM0tz74R2-0AFuHUjT1ggtmeOxVPRGtPuECWSO5oVNdgl1f4yBktL-u3kdDVmCoQ8jz-GcBDYZpFLv3dpAN8fNL11rHmpicWkE61FgLDziWuy_yBSaebPMkA0zU5b/s1600/image%25255B9%25255D.png)

![[image%255B9%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjpF2nlwF9LtpDc5TINcOe1CDJZ06nr2nzXAQXjg1j5GGM-nwOTrFgzDSEd14XZCpL4Re2b6_ZmFiZtifmD2HCjQTwxNZadBRaT5uEUP0E9Jvw7GUzbEZ8187JLoM-frDHhjHN62jmEo-sc/s1600/image%25255B9%25255D.png)