How does the Diocese calculate the Diocesan Assessment/DSP? See parish tithe at the bottom of the posting.

St. James Belvidere: the Diocesan Pledge is $103,313 which is approximately equal to 10% of St. James’ church revenue-- Total Collection $831,196, Donations $44,683 and Other Income $165,243 which totals $1,041,122. Is this the method? Parish burden—$103,313/1988 families(based upon 7% and 139 donors) = $51.97 per family.

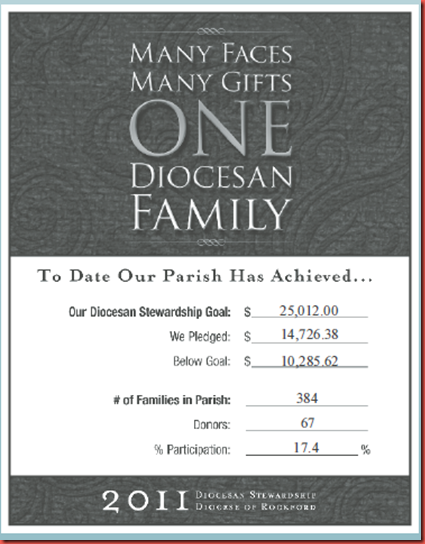

CLICK ON THE PHOTOCOPY TO ENLARGE:

Some other parish assessments are shown below:

St. Bridget: $116,182; 2146 families(based upon 17.1% and 367 families) ; $54.14 per family

St. Patrick’s, Rockford, Illinois—$25,012; 384 FAMILIES; $65.14 PER FAMILY.

Sacred Heart, Marengo, Illinois—$41,733; 799 families; $52.23 per family

The following is taken from: http://www.stewardshiprockford.org/capcamp/TithePolicy.pdf

Diocese of Rockford

Stewardship and the Assessment System

Approved on May 1, 1998

by Bishop Thomas Doran

Updated March 2009

Parish Tithe

I. Basic definitions and observations

The Parish tithe is the practice of designating a portion of the Sunday collection to be given as a gift in the name of the parish to a diocesan, community, national or world-wide charity. Parishes choose to institute this practice for three reasons: 1) to reach out and go beyond the parish's own needs in order to serve "the least among us"; 2) to evangelize, to give witness to others in wider community; and 3) to provide an example to the individual members to give to the parish in a planned, sacrificial and proportionate manner.

II. Diocesan Policy Statements

Implementation of Stewardship Goal

The parish contributes a portion of their Sunday offertory collection to worthy diocesan, community, regional, national and international programs.

Statement of Diocesan Assessment Goal

To encourage parishes to adopt the parish tithe and to assist diocesan and parish entities that are of special concern.

Statement of Procedures

1) Parish tithes up to 10% of Parish Ordinary Income will be deducted (by diocesan staff) from Ordinary Income before diocesan assessments are calculated.

2) When determining the recipients of the parish tithe, parish leaders are strongly encouraged to support the special concerns of the diocesan family. These include but not limited to:

* United in Faith Endowment Funds

* Poor parishes and schools needing special assistance

* Diocesan Social Ministries for the following purposes:

Direct financial assistance to poor people

One-time capital needs

Past due debt

Specific short-term special programs - projects

* Aurora Central Catholic High School Fund

* General Diocesan Financial Liabilities

* Other emergency needs as they arise and defined by the Diocesan Bishop

For more information, contact the Diocesan Director for Financial and Administrative Services.

3) When considering non-diocesan organizations, parish leaders must ensure that only legitimate not-for-profit organizations that uphold identifiable Catholic moral and social teachings are supported.

4) The parish will record these contributions under Apostolic Works line items: 47050-Direct Assistance or 47100-Donation in the Parish Uniform Accounting System.

5) Parish support to its own elementary, area high school, or payments of current or past-due diocesan assessments will not be considered as a deduction to Ordinary Income before diocesan assessments are calculated.

No comments:

Post a Comment