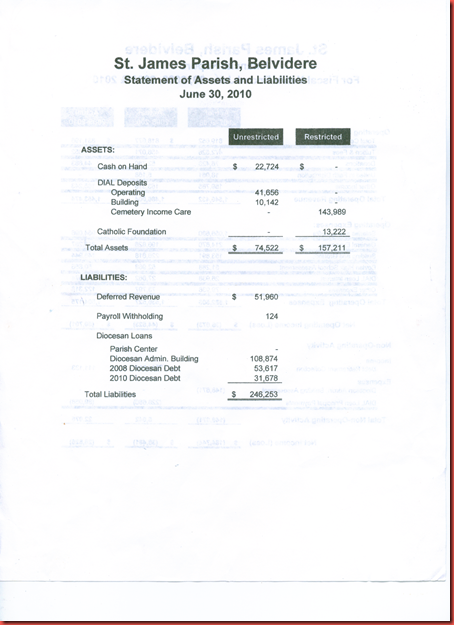

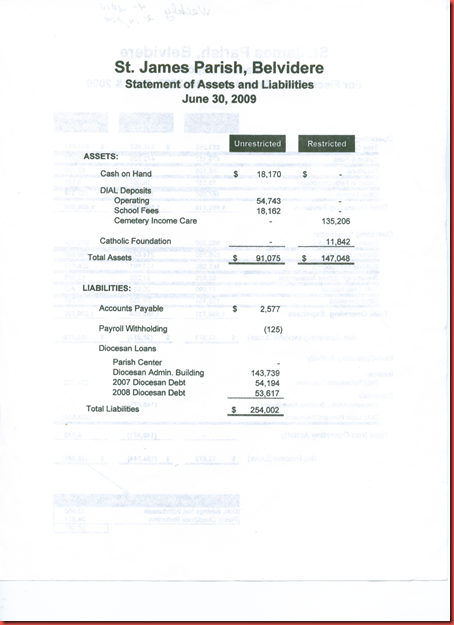

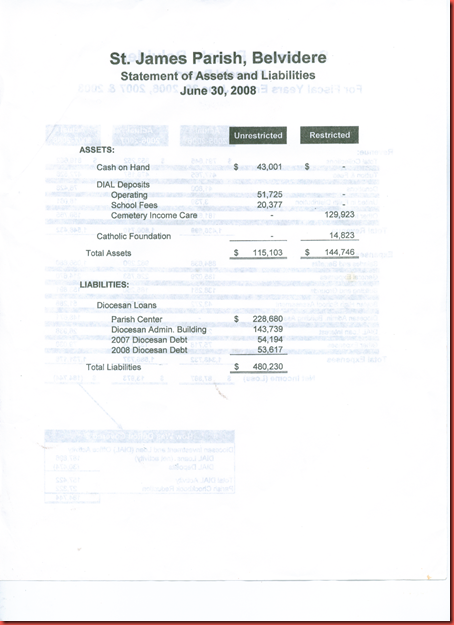

Below are the income and expenses for the parish for the last three years.

Operating expenses exceeded operating income for each of the past three years. (The operating net loss ranged from $36,073 to $50,701). Debt rose dramatically in FY 2008 due to the $148,671 assessment for the Diocesan Administrative Building. Because of the Debt Reduction program in FY 2009 and 2010, $317,738 of debt was retired and total debt decrease to $194,169 as of 6-30-2010.

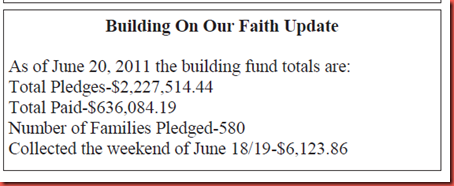

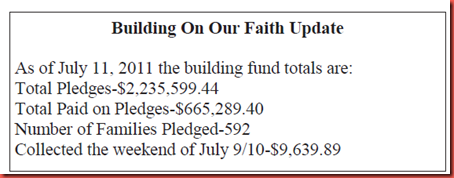

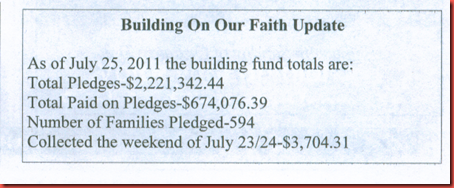

My understanding of the current New Church Pledge drive: To begin building this debt ($194,169) must be retired and then there must be $1,000,000 in the DIAL deposit account and a total of $3,000,000 pledged. Upon completion of the new church the parish will be left with a debt of $2.5-3.0 million. At just 5% interest on a $2.5-3.0 debt is an annual interest expense of $125,000-$150,000; I understand that the DIAL (Diocese Investment and Loan) interest rate will be 6%. Is there a way that operating income can bear this large expense? Basically regular contributions FY 2010 (see operating revenue) need to increase approximately 20% from $831K to $997. In FY 2009 such contribution were flat and in FY10 increased only by only 1.5%. Rollover of the interest to an ever increasing debt seems inevitable .

Income figures for FY 2011 should be available soon. Hopefully a detailed accounting of the New Church Pledge drive will be included.

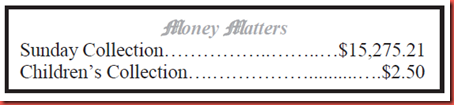

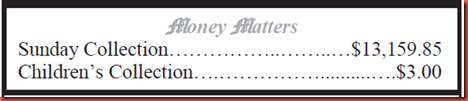

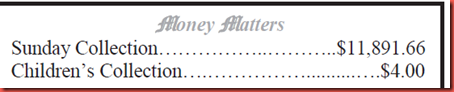

Here are the regular Sunday contributions:

June 11-12, 2011

June 18-19, 2011

June 25-26, 2011

July2-3, 2011

July 9-10, 2011

July 16-17, 2011

July 23/24, 2011

No comments:

Post a Comment